Since the crisis flared up, we have heard in many corners of society about the need to regulate more. I disagree. Let's see the role of regulation in the financial crisis.

Beyond the expansionist monetary policy, upon which anybody will agree the private sector has no control, regulations imposed upon financial intermediaries in retail real estate financing (for example the Community Reinvestment Act and its successive amendments, in 1995 in particular) and the modification of Fannie Mae and Freddie Mac status, the SEC has a huge responsibility in the development of the crisis. The SEC authorized the naked short selling (where the short selling is perfectly legitimate). This led to a situation where, in some instances, the number of shares in circulation was higher that the authorized number: the SEC never enforced the obligation to deliver shares on settlement day. The SEC also failed in its supervision role, as exemplified by the Madoff affair. This failure is not bound to the US and can be extended globally.

I am also not convinced that FAS 157 accounting rule had the magnifying role : if the abscence (or quasi-abscence) market/liquidity led to a collapse in prices, hence losses to be accounted for, it is due to:

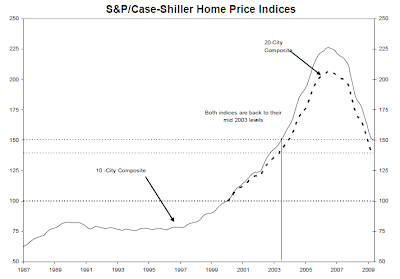

- The lack of buyer, nobody knowing where real estate prices would fall

- Investment banks had excessive debt (or lack of shareholders funds) particularly with respect to the imbalance of their balance sheets (short term financing on the interbank market and long term commitments). For example, class 3 assets (the most difficult to value) stood at 251% of shareholders funds Morgan Stanley, 185% for Goldman Sachs, 159% for Lehman Brothers and 105% for Citigroup.

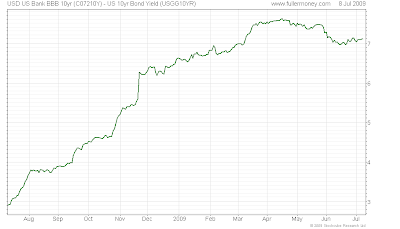

- Being in the same situation, banks knew the difficulties of their counterparties and the unstoppable collapse of their assets (mark-to-market or not); this is what conducted to the interbank market standstill.

Finally, Basle II rules require the use of complex mathematical models to fix the level of capital required for banks. When banks have a low level of losses (as it had been the case since the mid-90s), low level of capital are required which encourages the expansion of balance sheets. Conversely, when the period witnesses huge losses, like today, these models require a substantial increase in the capital base when it is not available, which led to the steep downsizing of banks' balance sheets (and we have not seen the end of it as yet). For example (and for illustration only), if the capital ratio is 1/10, any decrease of 1 billion of the capital base must translate into a 10 billion reduction in assets to comply with Basle II rules.

Derivatives are very useful tools for the real economy, particularly for hedging purposes (but not limited to), it is the excessive confidence in mathematical models that is damaging: remember the collapse of LTCM in September 1998 despite its two Nobel prizes; yet the FED saved it (in fact the banks counterparts) considering LTCM to big to fail...

We do not need more regulation and control but better regulation and control and make sure that useful existing rules are applied and useless/inefficient ones dropped. Policy makers see this crisis as one in a lifetime way to gain more control on the economy, on our life whilst in may cases they either created rules that magnified (or even sow the seed of) the crisis and did not do anything since the bubble started to implode in August 2007 until September/October 2008.